2021 Tax Filing Season Begins Feb. 12th

IRS Outlines Steps To Speed Refunds During Pandemic

- The Internal Revenue Service announced that the nation’s tax season will start on Friday, February 12, 2021. This is when the tax agency will begin accepting and processing 2020 tax year returns

- To speed refunds during the pandemic, the IRS urges taxpayers to file electronically with direct deposit as soon as they have the information they need

- People can begin filing their tax returns immediately but the IRS will not start accepting them until 2.12.21.

- Under the PATH Act, the IRS cannot issue a refund involving the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) before mid-February. The law provides this additional time to help the IRS stop fraudulent refunds and claims from being issued, including to identity thieves.

- Taxpayers will need to check “Where’s My Refund” for their personalized refund date.

TIPS FOR TAXPAYERS TO MAKE FILING EASIER

- File Electronically and use Direct Deposit for the Quickest Refunds

- For those who may be eligible for stimulus payments, but didn’t receive a payment or only received a partial payment, you may be eligible to claim the Recovery Rebate Credit when they file their 2020 tax return.

- Remember, advance stimulus payments received separately are not taxable, and they do not reduce the taxpayer’s refund when they file in 2021.

- Please Contact RTW to assist you with filing your return (855) 205-8486 or schedule a time to file remotely https://calendly.com/rtw-calendar

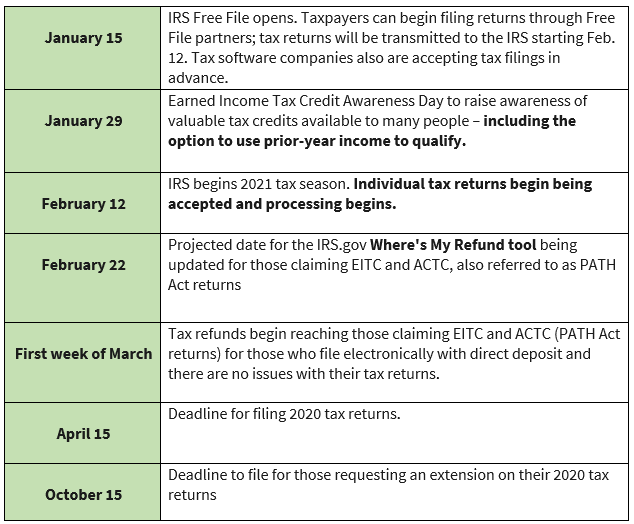

Important Tax Dates For 2021