NEW W4 – WHAT’S CHANGING? EVERYTHING!!!

NEW W4 – WHAT’S CHANGING? EVERYTHING!!! NEW DRAFT OF W4 EXPECTED TO BE RELEASED FOR COMMENT BY MAY 31, 2019 FINAL VERSION TO BE RELEASED

NEW W4 – WHAT’S CHANGING? EVERYTHING!!! NEW DRAFT OF W4 EXPECTED TO BE RELEASED FOR COMMENT BY MAY 31, 2019 FINAL VERSION TO BE RELEASED

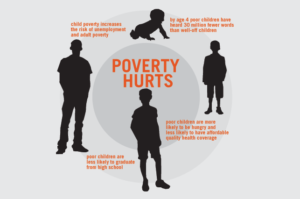

CHANGES TO TAX LAW Tax rates lowered. Starting in 2018, there are seven income tax brackets, ranging from 10 percent to 37 percent. Standard deduction

IRS REFUNDS: REFUNDS ARE BEING PROCESSED WITHIN A 2 WEEK PERIOD IF ELECTRONICALLY FILED SOME REFUNDS WILL NOT BE ISSUED UNTIL FEBRUARY 27, 2019 IF

The U.N. report faulted the Trump administration for pursuing policies it said would exacerbate U.S. poverty. In May, U.N. special rapporteur on extreme poverty and human rights

STATES RESPONSE State legislatures have reacted to the new $10,000 limit on the federal deduction for state and local taxes (SALT) with workaround legislation States

WHAT’S IMPACTED Half of the proposed cuts would come from two accounts within the Children’s Health Insurance Program (CHIP) CHIP is governmental funding to help

EXAMPLE: MATH: $5,000 TAX REFUND 2017 AND PRIOR UNDER OLD LAW $1,040 EXTRA ON 2018 PAYROLL CHECK UNDER NEW GOP TAX PLAN $3,960 LOSE UNDER

Unscrupulous Tax Preparer looking to make a fast buck from honest people Fraudulent Preparer will put fake business on returns at a loss to yield

TAX DAY DATE TYPE OF TAX RETURN March 15, 2018 Partnership 1065 S Corporation 1120S April 17, 2018 (normally 4.15) Personal Federal 1040, States

On February 9, 2018 President Trump signed the Bipartisan Budget Act; Tax Extenders Included Tax Returns including tax extenders were delayed; IRS and TAX Software

Letters from the IRS - Did You Know? - rtwxxact.com/letters-from-t… pic.twitter.com/2LX4l6ohSr

Last year from RTW Xxact's Twitter via RTWfeed

Financial Friday- Did You Know? - rtwxxact.com/financial-frid… pic.twitter.com/9PLONYjvY0

Last year from RTW Xxact's Twitter via RTWfeed

Tax Debt Settlement Scams – Did You Know? - rtwxxact.com/tax-debt-settl… pic.twitter.com/Cgp3fcPKqe

Last year from RTW Xxact's Twitter via RTWfeed

Filing Extensions and Minimizing Penalties – Did You Know? - rtwxxact.com/filing-extensi… pic.twitter.com/Opxf6vtVAf

About a year ago from RTW Xxact's Twitter via RTWfeed

Reducing Fees & Penalties - Did You Know? - rtwxxact.com/reducing-fees-… pic.twitter.com/9hNARkxD7V

About a year ago from RTW Xxact's Twitter via RTWfeed

Letters from the IRS - Did You Know? - rtwxxact.com/letters-from-t… pic.twitter.com/2LX4l6ohSr

Financial Friday- Did You Know? - rtwxxact.com/financial-frid… pic.twitter.com/9PLONYjvY0

Tax Debt Settlement Scams – Did You Know? - rtwxxact.com/tax-debt-settl… pic.twitter.com/Cgp3fcPKqe

Filing Extensions and Minimizing Penalties – Did You Know? - rtwxxact.com/filing-extensi… pic.twitter.com/Opxf6vtVAf

Reducing Fees & Penalties - Did You Know? - rtwxxact.com/reducing-fees-… pic.twitter.com/9hNARkxD7V

Copyright © 2022 | RTW Xxact Enterprises, LLC | Bringing it All Together.