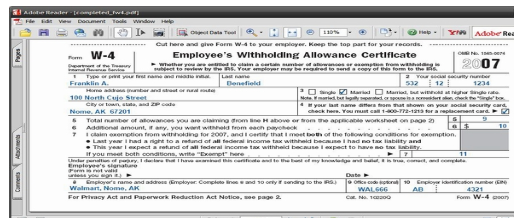

NEW W4 – WHAT’S CHANGING? EVERYTHING!!!

- NEW DRAFT OF W4 EXPECTED TO BE RELEASED FOR COMMENT BY MAY 31, 2019

- FINAL VERSION TO BE RELEASED BY THE END OF THE YEAR IN TIME FOR 2020.

- WHAT’S NEEDED FOR THE NEW FORM

- Your filing status (Single, Married, MFS, HOH)

- Number of dependents

- Itemized Deduction information (mortgage interest, state and local taxes, charity, etc.)

- Information about NONwage income (business income, interest, dividends, etc.)

DO YOU AGREE WITH WHAT THE IRS IS ASKING? SOME FEEL IS WAY TO INTRUSIVE – LET US KNOW YOUR THOUGHTS.RTW FEELS THAT PROVIDING NONWAGE INFORMATION TO AN EMPLOYER IS UNACCEPTABLE – LETS SEE WHAT HAPPENS.

WOULD YOU LIKE TO KNOW WHAT CRYPTOCURRENCY IS? LOOK FOR TRAINING COMING SOON!!!

“FIRST CLASS SOLUTION SUITE”

CONTACT RTW TODAY FOR ALL YOUR TAX AND BUSINESS NEEDS DOMESTIC AND INTERNATIONALLY. DON’T WAIT, CALL OR EMAIL NOW.

Business Email Blog! Can also find this one and previous blogs at www.rtwxxact.com

By Robbie Terry-Washington, CPA

Contact info: info@rtwxxact.com

OFFICE: GA: 470-441-5140 OH: 216-282-9706 CELL: 216-533-6586 FAX 855-541-5140

Send secure files https://rtwxxact.com/contact