TAXPAYERS MAY RECEIVE IRS 5071c LETTER

- To combat identity theft and fraud, the IRS may require additional information

- This additional information requirement is part of their Taxpayer Protection Program

- If you receive form 5071c from the IRS

- Do NOT ignore the letter

- Verify the information requested

- Failing to do so may result in a delay in your refund.

- If you were previously a victim of identify theft, you should have received an IRS IP PIN that should be included on your tax return.

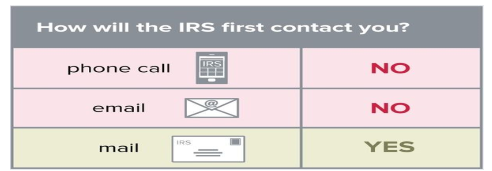

- Remember you should never respond to a call or internet – only mail and even the mail is suspect. Be sure to confirm that the letter came from the IRS.

- 1-800-829-1040 – call this number if not sure

WOULD YOU LIKE TO KNOW WHAT CRYPTOCURRENCY IS? LOOK FOR TRAINING COMING SOON!!!!!

“FIRST CLASS SOLUTION SUITE”

CONTACT RTW TODAY FOR ALL YOUR TAX AND BUSINESS NEEDS DOMESTIC AND INTERNATIONALLY.

DON’T WAIT, CALL OR EMAIL NOW.

Business Email Blog! Can also find this one and previous blogs at www.rtwxxact.com

By Robbie Terry-Washington, CPA

Contact info: info@rtwxxact.com

OFFICE: GA: 470-441-5140 OH: 216-282-9706 CELL: 216-533-6586 FAX 855-541-5140

Send secure files https://rtwxxact.com/contact