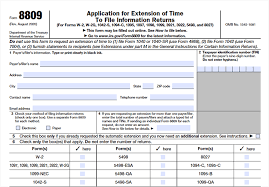

For those who have found themselves in need of a filing extension for W-2 Forms & 1099s, an extension can be filed which allows filings to be submitted until 2/28/2023. However, anyone requiring extension must complete IRS Form 8809, or contact us at RTW Xxact Enterprises today ready to provide the needed information so that we can complete an e-file of the extension with those who need assistance.

Form 8809 is used to request an initial or additional extension of time to file only the forms shown on line 6 for the current tax year. Note: extension requests for forms 1099-nec, 1099-qa, 5498-qa, and w-2 must be submitted on paper.

You must file form 8809 by the due date of the return you want to extend. For example, form w-2 is due January 31. Likewise, you must file form 8809 by January 31.

Therefore today is the Last day to file for 1099 extension. We request the information to be uploaded to our portal by using the following link https://www.rtwxxact.com/contact/ immediately.

Contact us at by email: buz@rtwxxact.com.