Scammers constantly develop new ways to impersonate the IRS and steal the money and/or identities of taxpayers. Most often, these scams come in the form of text messages, emails, or phone calls. However, the IRS recently issued a new warning about a scam that uses traditional mail delivery.

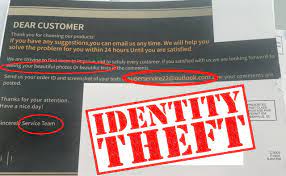

In this new scam, taxpayers receive a letter by postal mail, or in a cardboard envelope from another delivery service. Printed on what appears to be IRS letterhead, the letter states that the taxpayer has an unclaimed tax refund. However, the phone number and address shown do not belong to the IRS. The letter asks the taxpayer for sensitive personal information, including their Social Security number (SSN), telephone number and photos of their driver’s license. The scammers then use this information to steal the person’s identity.

Legitimate IRS letters do not ask for personal information in this way. The scam letters also often have awkward phrases like, “Try to be watching your email.” If you receive a suspicious letter that claims to be from the IRS, do NOT respond. Instead, call a legitimate IRS phone number, such as 800-829-1040, to find out whether the notice is genuine.