To All Business Owners:

APPLIES TO SINGLE AND MULTI MEMBER LLCS, S CORPORATIONS AND REGULAR CORPORATIONS

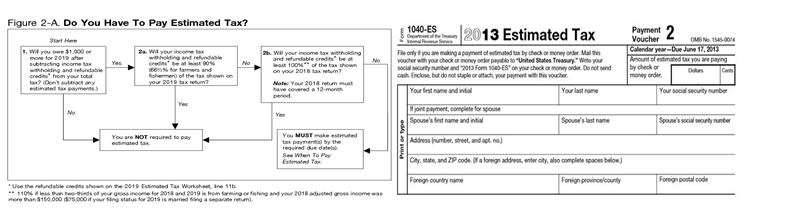

If you owed taxes in the prior year and have not made any changes (credits, deductions, etc.,) you may need to pay estimated taxes for Federal and State.

Normal Due Dates are as follows:

• April 15th

• June 15th

• September 15th or Next Business Day

• January 15th (following year)

However, the IRS & States will accept your payments anytime through January 15th of the following year. Additionally or in conjunction to reduce your tax liability, you can contribute to your Business IRA (SEP IRA / SIMPLE IRA) or create one and you have until April 15th of the following year to make the contribution.

Please e-mail RTW if you have any questions or need clarification. Thank you!

“FIRST CLASS SOLUTION SUITE”

By Robbie Terry-Washington, CPA

Contact info: info@rtwxxact.com

OFFICE: GA: 470-441-5140 OH: 216-282-9706 CELL: 216-533-6586 FAX 855-541-5140

Send secure files https://rtwxxact.com/contact